Sunday, August 29, 2010

Who are You ???

The introduction which you had given is really not about yourself but pertaining about your body, Suppose if you had taken the birth in christian family you will be called upon as a christian.

You are a Soul, an eternal and immortal Soul. You are different from your body.

Let me expain you that how you are different from body and how you identify yourself that you are a Soul. Supose if your hands or eyes gets strain than you will say that my hands are paining, but you will not say like "I hands are paining" My and I is different, than who is I. I is your self and yourself is nothing than other soul.If soul is not there in our body we become death. Soul is a driver and our body is the car. Soul drives our body and it is a soul that derives pains, happiness, peace, arrogantness, pleasure through the medium of our body.

when a patient comes to the hospital for his treatment he would be called by his own name and no sooner he dies, he would not be called by his name but he would be called as dead body. so it is this soul which has left our body and gets disappear in to the universe to capture the another body to complete or rather to play his role.

So, finally if we consider ourself that we are a soul and not the body than this life will become heaven and everybody will consider one another equal as all human beings are soul. Body differs by the name, country, religion, culture, place and nation. These conflicts, war, terriossism, battle, hatred, oppostion, difference of opinion, anger, attachment are all sign of our bodies and not soul.

Thursday, June 24, 2010

Tax Invoicing, VAT, Excise Billing Software

Saturday, May 22, 2010

Pure Thoughts / Impure Thoughts

Thursday, April 1, 2010

5 Mantras to survive from slowdown in the Stock market

Step one: Stay Calm. Don't panic and make rash decisions. Even though you know that selling shares of good companies or mutual funds is the worst thing to do, it is often the first thing that comes to your mind. Of course, this is not to say that if there is money in high-risk, high-return mid-or small-cap funds or stocks, you should not move them. But take a call after you have properly analysed losses that would have incurred in the process. Yes, these are times when you have to be more alert, but translating your alertness into immediate action need not be necessary. You should opt for rational decisions in such times.

Step two: Just a while ago, you would have got calls from head hunters and felt ultra-confident about yourself. But with changing times, it is more likely that these calls will slow down, and so will hikes being offered by companies that are recruiting. Even your own company may not give much of a hike in the next year. But it's time that you do not look at hikes and increments. Instead, be defensive about your existing job. There are several ways of doing this -- right from taking in more responsibilities to improving your skill sets. This could mean putting in more hours, if possible, and working harder and smarter. Be prepared for situations, where your company is pruning its existing workforce and more workload may be coming your way.

Step three: Create a contingency fund aggressively, if you have not already done so. It is far more important now to have that additional cushion. Have at least 4-12 months of expenses in the liquid form, that is, in savings account and fixed deposits, at all points of time. If only a single member of the family is working then it is imperative to have more funds in the emergency kitty. Additionally, take stock of what you can sell in such markets without incurring a loss. Can you borrow against fixed deposits, take a loan against your LIC [Get Quote] policy and withdraw from PPF or EPF? Do you have gold that you could possibly sell? Evaluate all possibilities and be ready for all contingencies.

Step four: Perhaps, not taken too seriously, but the most important point -- reduce your expenses. There are two types of expenses: mandatory (groceries, child's education, home loan) and voluntary (entertainment, vacation, eating out and others). While there might be no way of scaling down mandatory expenses, voluntary ones can certainly be scaled down. However, even dealing with your mandatory expenses smartly can help matters. For instance, if you have high-interest home loans (most would have gone up to 12.25 per cent), you can look at refinancing it as there are banks that will offer you a loan for around 10.00-10.5 per cent. This can result in a reduction of the equated monthly instalment (EMI) and improve your cash flows. But it comes at a cost. So you will need to do a cost-benefit analysis of the loan transfer before going for it. If you are paying very high interest rates on credit cards and personal loans, you could do a 0 per cent balance transfer for three months (or slightly more), but refrain from using them till you clear the debt. If you really need to raise cash, opt for relatives instead of institutions or use your fixed deposits, real estate and other investments.

Step five: Have a proper savings budget and continue with your investments in PPF, EPF, SIPs and gold. Most importantly, this is not the time to be adventurous for investing in short-term equity. Doing all the above means you are much better prepared to tackle the bad times. It's important to pre-empt rather than take drastic measures in the future.

Friday, March 19, 2010

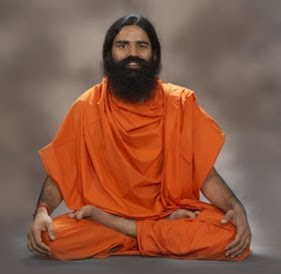

Soul Conscious

The introduction which you had given is really not about yourself but pertaining about your body, Suppose if you had taken the birth in christian family you will be called upon as a christian.

You are a Soul, an eternal and immortal Soul. You are different from your body.

Let me expain you that how you are different from body and how you identify yourself that you are a Soul. Supose if your hands or eyes gets strain than you will say that my hands are paining, but you will not say like "I hands are paining" My and I is different, than who is I. I is your self and yourself is nothing than other soul.If soul is not there in our body we become death. Soul is a driver and our body is the car. Soul drives our body and it is a soul that derives pains, happiness, peace, arrogantness, pleasure through the medium of our body.

when a patient admits to the hospital for his treatment he would be called by his own name and no sooner he dies, he would not be called by his name but he would be called as dead body.So it is this soul which has left our body and gets disappear in to the universe to capture the another body to complete or rather to play his role.So, finally if we consider ourself that we are a soul and not the body than this life will become heaven and everybody will consider one another equal as all human beings are soul.

Body differs by the name, country, religion, culture, place and nation.These conflicts, war, terriossism, battle, hatred, oppostion, difference of opinion, anger, attachment are all sign of our bodies and not soul.For more please refer to http://www.brahmakumaris.com/

Thursday, February 25, 2010

Investing in Gold and In Real Estates is better option than any other Options

Gold is not needed for the jewellary but it is a one kind of investemnt to oppose inflation. As the price of the gold rises day by day and it has reached up to Rs 18,000/- per 10 grams and it is earmarked rise and has to be notify about it.

Secondly, investment in real estates also counts. A person taken a house at Mira Road with one bedroom hall and kitchen before 8 months at around 8 Lakhs sold at a premium of Rs 10,00,000/- within arange of 8 months. So, there is a immense growth of wealth in these two sectors and more obiviously one has to invest a huge capital.

With gold, one can buy the raw gold and also the Gold Bond issued by the government of india and commercial banks in the form of gold coins and bars and with real estate one has to buy a plot of land which costs no more than atleast 75,000/- more in the remote areas.

The other advantges of investing in Gold is it is not volatile like other currencies and it is more stable and the safest kind of investment. Secondly gold is the best security to obtain loans from the bank.

.jpg)

.jpg)

.jpg)